The same health benefits that drive cyclists to go the extra mile can also help you save money on life insurance — and not just a few pennies.

The same health benefits that drive cyclists to go the extra mile can also help you save money on life insurance — and not just a few pennies.

Insurance is all about risk. Higher risks are reflected in higher insurance rates. Lower risks provide lower rates — but the underwriting methods can make a huge difference.

HealthIQ has done the research and now provides reduced-rate term life insurance that rewards cyclists and other health-conscious clients for their good health — and relatively lower risk. This innovative insurance agency advertises a potential savings of up to nearly $10,000 over the duration of a 30-year term policy, enough for a new bike or two.

Over half of HealthIQ’s clients qualify for their best rate — but even if you don’t qualify for the top tier of preferred plus, HealthIQ can use its world-class underwriting team to shop up to 30 life insurance carriers, helping you find the coverage you need at a price that fits your budget.

The Difference is in the Underwriting

The concept behind HealthIQ underwriting isn’t that other insurance underwriting guidelines are getting it wrong — but rather that the science hasn’t been fully considered.

HealthIQ applies modernized research to many of the factors that often cause health-conscious and athletic life insurance applicants to be rated inaccurately as a risk. More accurate rating based on in-depth health-related science provides lower rates.

Preferred Plus — The Best Rating: Compared to the industry as a whole, HealthIQ is able to place twice as many applicants in the exclusive preferred plus rating group. Only 35% of life insurance policies are placed at preferred plus industry-wide. By utilizing underwriting guidelines specifically tuned for cyclists and other health-conscious groups, HealthIQ is able to place 70% of its policies in this selective rating group.

Among the special underwriting considerations used by HealthIQ are:

- Adverse Family History — Genetics don’t always tell the full story

- BMI — Muscle weight isn’t a bad thing, but other insurers sometimes think so

- Well-managed conditions — If it’s under control, it’s less risky

- Savings for a low resting heart rate — other insurers might penalize for this

- Special rates for Vegans — Yay! Pass the tofu, please.

- Special consideration for a low carb diet

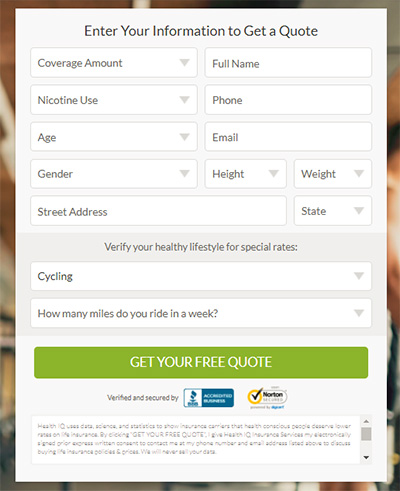

Sign Up For HealthIQ

Why are Cyclists Rated as a Lower Risk for Life Insurance?

Getting into the specifics for cyclists, HealthIQ reports that cyclist has a 28% lower all-cause mortality rate during coverage terms than non-cyclists, based on cyclists who ride 3 hours per week or more.

Reports also indicate cyclists who rack up 30 miles or more each week have a lower incidence of cancer compared to non-cyclists. More great news.

As you might expect, the incidence of heart disease is lower as well for cyclists when compared to non-cyclists. One study shows an 18% reduction in heart disease. Cyclists were also found to have 15% higher levels of HDL Cholesterol, the “good” cholesterol.

All these factors, combined with a health-conscious lifestyle, lead to longer lives for cyclists. Male cyclists live up to 5.3 years longer than non-cyclists, while female cyclists live up to 3.9 years longer than non-cyclists.

Why HealthIQ for Life Insurance?

Less than half of U.S. households own individual life insurance policies. Group insurance policies offered through employers aren’t owned by the insured and can disappear in an instant if you change jobs. Group policies also typically for small coverage amounts — probably much less than your mortgage and college for the kids. Put a question mark next to those.

Licensed in all 50 states and experts in underwriting that’s optimized for the uber-healthy, HealthIQ can save money on term life protection and help you design a customized policy based around your needs. Lower rates help ensure long-term affordability.

If you need term life insurance or were thinking of adding to the coverage you already have, we like what HealthIQ is doing for health-conscious people — and for cyclists in particular.

Sign Up For HealthIQ